For startups looking to streamline their payroll processes and manage employee compensation efficiently, a payroll software is the perfect solution.

With payroll software, startups can eliminate the need for manual calculations and paperwork, reducing the risk of errors.

The good news is, now they can opt for a good payroll tool designed especially for small businesses. Which means, less learning curve, and quick ROI from the payroll solution.

Let’s dive deeper, how such a payroll solution can help startups save time, effort, and money.

What is payroll software? Are there Payroll software for Startups, specifically?

Payroll software is a digital tool designed to automate and simplify the process of managing employee payroll. It allows HR teams or the admins to calculate and process salaries, generate pay slips, and handle tax obligations seamlessly.

And yes, OpportuneHR is a HR software especially created for startups, SMEs and small businesses. While other software can seem overwhelming, this one is a payroll system designed for the small businesses.

To give you an example: It you go feature by feature, all software looks the same. But to get the best ROI these software must be configured well by the client. Now Startups may not have sufficient expertise to make the best use of rule engines in these software.

OpportuneHR excels here. It comes pre-configured for all your needs!

Which saves time, effort and learning curve. In effect, you begin to use it as soon as it is implemented in your organisation.

Why is payroll software important for startups?

Many startup founders ask: why do we need a payroll software when we only have a small team? That’s a valid question and must be answered.

Explore How Integration of Payroll Software Good For SMEs

We can look at it from various viewpoints.

Here are a few reasons why payroll software is crucial for startups:

- Accuracy and Compliance : Payroll software ensures accurate calculations and compliance with tax laws and regulations. This helps them avoid penalties and legal issues. Startups are low on bandwidth and the core focus should always be gaining new clients and developing the product as per market response.

The payroll and statutory compliance related complexities can derail the growth journey. Payroll software is a saviour.

- Time and Cost Savings : Automating payroll processes saves time and reduces the need for extensive administrative work, allowing startups to focus on core business activities.

Salary deposit to employees’ bank account makes it easy for all.

But it goes much beyond that!

In the early phase the work culture of the organisation is created. A payroll software helps in professionalising the HR activities. It is always a good signal for prospective investors. It surely adds to the overall perception about the startup.

- Employee Satisfaction : By providing employees with accurate and timely pay, payroll system helps maintain a positive work environment and boosts employee satisfaction. Employee portal, tax documents, and tax reports helps enhance employee satisfaction.

- Data Security : Payroll software stores employee data securely, protecting sensitive information from unauthorized access.

Now, if a payroll system is that useful, why do startups postpone implementing it?

5 Reasons Why Startups Postpone Using Payroll Software

Here are five common reasons why startups tend to delay implementing payroll software–

- Limited Budget:

Startups often grapple with limited financial resources, so software cost is a significant factor when considering new software. Payroll platform is seen as an additional expense that might strain the budget.However, it’s important to weigh the upfront costs against the long-term savings and efficiency gains. Most payroll software solutions offer value-for-money packages tailored for startups, with options to scale as the business grows.

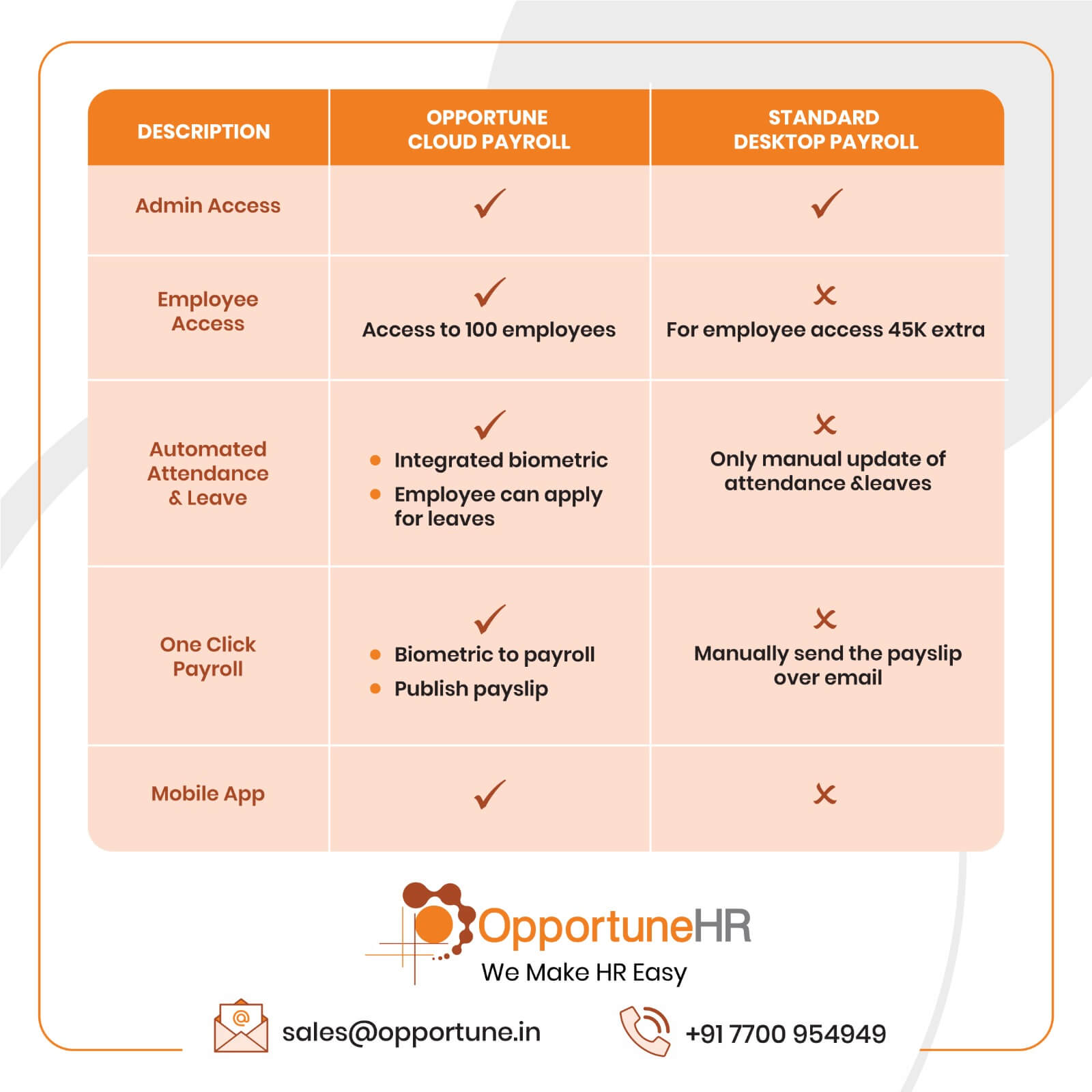

OpportuneHR offer for startup

- Lack of awareness:Some startups may not be fully aware of the benefits and features of modern payroll software. They rely on manual processes or outdated systems, assuming that they are adequate for their needs.

In early phase it might be true, too.

But once the employee count goes above 20, things change. Often the salary and benefit structures of Startups are complex because they offer equities and other unconventional benefits to early stage employees.

If we weigh the cost of handling complex payroll processes like automating tax calculations, generating payslips, and simplifying compliance, implementing a payroll software is a no-brainer choice!

- Security concerns:

Startups often worry about the security and confidentiality of employee data when transitioning to payroll software. Again, the concerns are legitimate. But reputable payroll software vendors prioritize data security, implement stringent safeguards such as data encryption and regular backups.The truth is, data is more secure on a payroll software, then excel sheets and other modes of documenting.

Key Features of Payroll Software for Startups

- Pre-configured payroll software

Payroll software are created for HR teams. But startups may not have the requisite HR expertise in house. So, make sure that the software is pre-configured for your industry and organisation needs. - Employee self-service

Employee self-service is a crucial feature of payroll software for startups. It empowers employees to manage their own payroll-related tasks, such as viewing pay slips and tax forms, updating personal information, and accessing important documents.This reduces the administrative burden on HR and payroll teams. And also provides employees with convenience and transparency about their payroll information. Startups can benefit from this feature as it promotes employee engagement and streamlines internal processes.

- Self-updating compliance changes

Take a special notice here. The payroll compliance and statutory guidelines changes too frequently. It is hard even for experienced HR managers to keep updated about these changes.But not all payroll software vendors deliver this. Desktop software does it only in their updates and upgrades. And many cloud software vendors supply a list of changes which the client team updates in their system.

These steps help, but there is always a chance of error.

So make sure your payroll software vendor guarantees the regular auto-updates of compliance in the system.

- Tax calculations and filings

Startups need payroll software that can handle complex tax calculations and filings.This feature ensures accurate calculations of income tax, Medical benefits, and payroll taxes. The software should also generate tax forms and reports required by local tax authorities.

By automating these tasks, payroll software helps startups avoid costly errors and penalties, freeing up time and resources for other business priorities.

- Automated payroll processes

Automated payroll processes are a game-changer for startups. From calculating employee wages to processing payments and generating reports, payroll software automates time-consuming tasks.This not only saves valuable time but also minimizes the risk of human error. With automated payroll processes, startups can ensure timely and accurate payroll processing, boosting efficiency and compliance.

By investing in reliable payroll software, startups can focus on growing their business while effortlessly managing their payroll responsibilities.

Benefits of Using Payroll Software for Startups

Time and cost savings

Using payroll software can significantly save startups time and money. Manual payroll processing can be time-consuming and prone to errors, whereas payroll software automates the entire process.

It streamlines tasks such as calculating wages, generating pay slips, and filing tax forms. This frees up valuable time, allowing business owners and HR teams to focus on other important aspects of the business. Automation also reduces the risk of costly mistakes and penalties that can occur with manual processes.

Accuracy and compliance

Startups need to ensure accurate and compliant payroll processing. Payroll software eliminates the risk of human error in calculations and ensures accuracy in tax withholdings, benefits deductions, and overtime calculations.

It also helps businesses remain compliant with changing tax laws and regulations, avoiding any legal issues or penalties.

Scalability for future growth

As startups grow, managing payroll can become more complex. Payroll software offers scalability, allowing businesses to easily accommodate increasing employee numbers, handle multiple pay rates, and adjust benefit plans.

Startup ownersappreciate the real power of payroll software when there is a sudden burst of market demand and the new recruitments happen on a big scale. In these circumstances the payroll software takes so much burden from their shoulders. They can focus on capitalise on opportunities rather than getting involved in complex salary and tax processes.

Conclusion: Opportune is the best payroll software for startups!

Implementing payroll software for small businesses can revolutionize your payroll processes, streamline operations, increase accuracy, and free up valuable time. Especially with a software like OpportuneHR the learning curve is deminished, the intuitive interface and employee self service, the HR team is free to look after policies and documentation, rather than getting engaged in salary disbursement complexities.

A good integration with attendance software, accounting software would make it even more useful for startups.

Opportune payroll software is a valuable tool that helps startups streamline their payroll processes, save time and costs, and ensure accurate and compliant payroll management. By investing in it startups can effectively manage employee compensation and focus on growing their businesses.