All business owners know this well– nothing motivates an employee more than money! They work hard in anticipation of getting their salaries on the promised day. At the same time, if they don’t get their salary on the day, it demotivates them.

But they don’t understand the complexities that payroll teams face.

To disburse salaries on a given date is one of the biggest challenges for the HR team. It should also be accurate and follow payroll compliance. Overall, a cumbersome process.

The online payroll management software is the answer!

In this article, let’s see how an online payroll system makes the payroll team’s job easy, increases their efficiency and guarantees accuracy and compliance.

What Is Payroll?

Payroll is a process of distributing salaries to employees or professionals working for an organisation for designated hours. Although it seems like simply paying a salary on the designated date, it is not that simple.

What Payroll Problems Do Online Payroll Software Solve?

Payroll involves an employee list of who gets paid, including part-time employees. The process consists of the creation of a payment policy, payslip structure, gross and net salary calculation, post-salary deductions, and ultimately releasing the salary. Moreover, it does not just end here. The payroll process also involves filing and depositing PF, TDS, etc. to various authorities concerning each employee.

As mentioned above, payroll has two significant components, namely, gross and net pay. The general calculation is as follows:

Net salary = gross earnings– deductions

This complex process requires tremendous man-hours and various processes. That’s not all, legal compliance, labour law adherence, and statutory compliance must be adhered to.

Online payroll management system: HR Tech for your Human resource department

With such complexities, payroll mistakes happen all the time. Particularly when it depends on manual processes, it causes delays in salary payments and affects the morale of your organisation, ultimately leading to losses.

That’s why it is advisable to avoid manual calculations, excel sheet mergers, and desktop software.

It is essential to have a robust cloud-based payroll management system to prevent these issues and enhance business productivity.

Payroll management system

A payroll management system is a cloud-based, online platform that processes the payroll of the entire organisation using software tools in a few minutes. The online PMS can track and keep payroll records using different inputs like tax calculations and deductions, leaves, ESI calculations, and more. The platforms also calculate payroll amounts and manage taxes using an effective solution for smooth business functionality.

The PMS also automates payslip and payroll report generation. Advanced payroll software comes with cloud access and multi-device functionality. A good payroll management software customises payroll requirements depending on the business’s nature and size. Whether you are a business with 100 employees or 10,000, a payroll system can be customised for your unique needs.

Features of a cloud-based online payroll management system

With the importance of an effective payroll management system established, an efficient online payroll software offers unique features like:

- Seamless integration of different payroll factors

An online payroll management system considers employee attendance – a prominent factor in the salary calculation. The attendance record and marking reduce admin work and feature everything on one comprehensive platform. In addition, automation eliminates errors and their possibility.

- Automates employee paycheques by syncing employee bank data

The hr and payroll software maintains a data file of employee bank details for automated payment transfer on the respective date.

- Salary accounting

It is a tedious component of payroll, and automation can improve its efficiency. The Payroll software can calculate net salary and expenses without manual interference. The efficient system records all the past pay cheques and tallies all other accounting requirements.

- It effectively integrates tax management

The in-built tax management system calculates different taxes automatically using various parameters. The organisation needs to pay the tax amount to the respective authority, and the software ensures it is done on time.

- Statutory compliance

The payroll process also involves abiding by certain laws and updating the system as per new government rules and regulations. While desktop software takes care of salary calculations to some extent, rapidly changing compliances are a headache for HR. Online payroll software automates the legal and statutory compliance, ensuring the organisation and employees abide by the law.

- Cloud integration

A payroll management system needs to have omnichannel accessibility. Cloud-based payroll software offers 24 x 7 accessibility. Moreover, it also guarantees data security. The large database of these systems stores big data and features multi-device accessibility.

OpportuneHR: The perfect example of a leading online payroll software

OpportuneHR is an award-winning HR tech company. Its HR domain knowledge, coupled with technology expertise, makes sure it works smoothly in real-life scenarios.

Cloud-based online payroll management software performs all-around work for all types of organisations and industries. Whether you are in the manufacturing industry or hospitality, IT business or healthcare, OpportuneHR can customise for your unique requirements. It eliminates the need to perform redundant tasks manually and ensures a timely salary disbursement.

In addition, the system offers the following benefits:

1. The automated payroll system saves time

The automation features of this online payroll software ensure HR personnel and other accounting staff save potential time performing manual tasks. The organisation only needs to set up the software in the beginning, and other processes follow. Opportune team’s support in the implementation of the payroll software is exemplary.

2. The system features high affordability

The system processes complex tasks and ensures optimal handling and timely completion. The automated features guarantee faster processing, eliminating the need to make additional investments for onboarding human resources.

In addition, the software generates online payslips and forms, eliminating conventional paper-dependent processes. The cloud-based software eliminates the hardware requirements. Organisations only have to opt for one-time costs followed by nominal fees, which are less than traditional investments. All these benefits ultimately lead to cost-effectiveness.

That’s why startups and SME businesses also use this enterprise-level payroll management system.

3. Addresses remote working challenges

Cloud-based online payroll management systems offer online capabilities, making them adaptable for different businesses. One prime benefit of these systems is their remote accessibility. It supports remote workforce management with features like attendance marking. Geofencing, a perfect solution for field force.

Additional benefits:

- It eliminates the need for onboarding experts

- Seamless operations

- Scalability

- Easy employee access

OpportuneHR – the best online payroll solution for your organisation

Consistent salary disbursement guarantees employee retention and satisfaction. Hence, OpportuneHR ensures effective salary management with

features like:

- One-Click Payroll: The salaries can be disbursed on any given day. Organisations simply have to decide the salary date. With the power of a click, payroll processing is done. The system is accurate and fast.

- Highly Configurable Payroll System: Businesses can define their custom parameters like salaries, pay grades, and job roles. It also offers additional parameters like Flexi-CTC, taxation, and payslips.

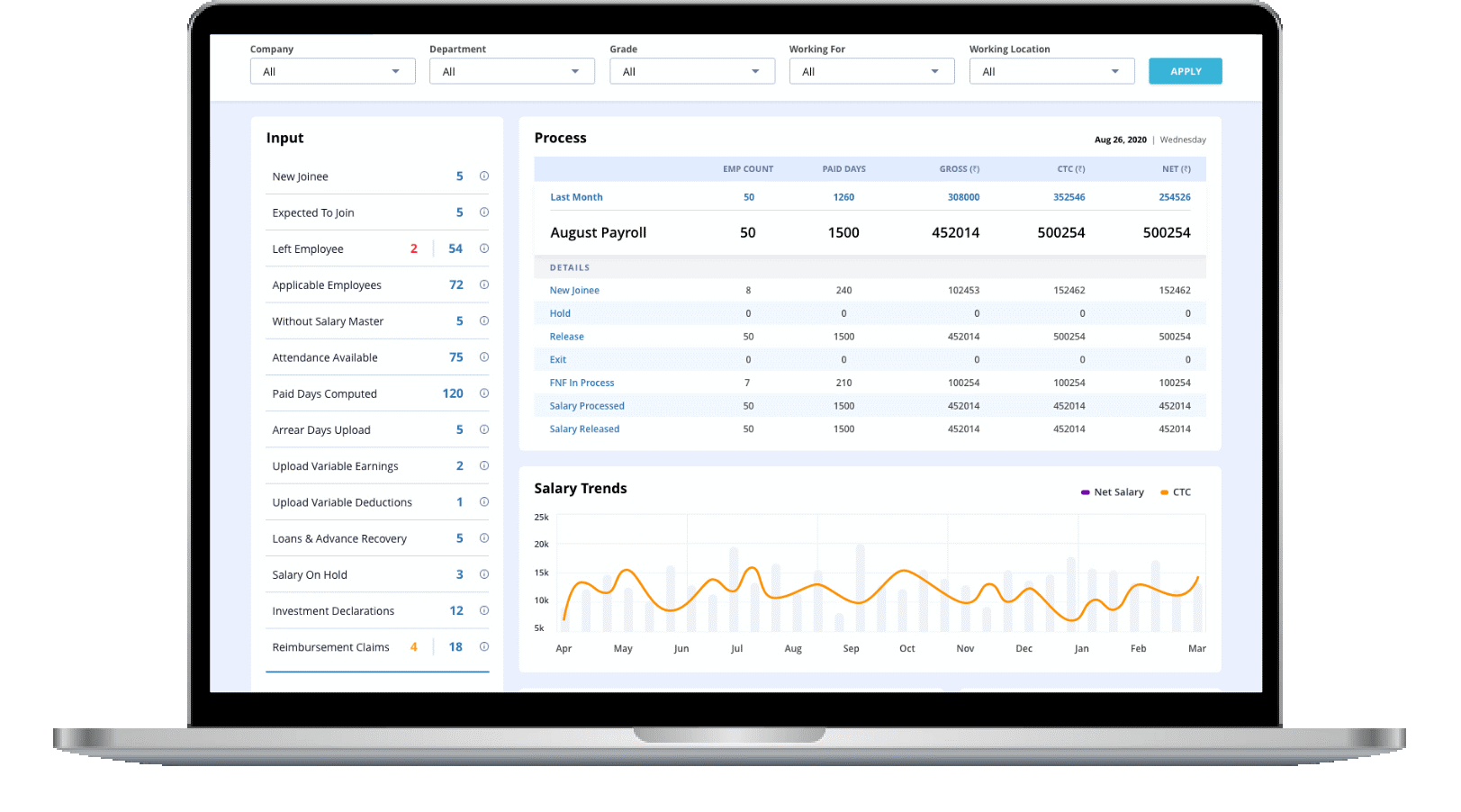

- Comprehensive Payroll Dashboard: Keep track of all payroll requirements using a comprehensive dashboard to offer information.

about new onboarding, employee exits, arrears, F&F, increments, month-on-month payroll analysis, trends, etc. - Payroll Controller: HR personnel can review the final salary register, lock monthly payroll, and generate quarterly TDS reports, along with compliance payments.

Tax Compliance: Tax compliance is complicated, especially with factories and offices in different states. A payroll software takes care of all these with no hassles.

Final thoughts!

Online payroll software takes a lot of administrative burden away from the HR team. Payroll processing automation is a prominent aspect of workplace productivity. Hence, it is essential to have a payroll management system that optimises all these processes and ensures employee satisfaction.

Accurate salary disbursement with no discrepancies and transparency helps retain good talent in the organisation. In particular, the young workforce wants modern software and self-service.

OpportuneHR is one of the best online payroll solutions. As a technologically advanced online payroll management system, it guarantees high productivity. For instance, we can process 30K payroll in under four hours, 30K TDS computations in one hour, and F&F calculation for 3K employees in twenty-eight minutes. The user-friendly mobile app is the icing on the cake.

To know more, contact us today!

FAQs About Online Payroll Management System

1. Why do you need an online payroll management software?

An online payroll management software streamlines salary processing, tax calculations, and compliance management. It eliminates manual errors, saves time, and ensures that employees receive accurate and timely payments. Businesses of all sizes benefit from automated payroll processing, making HR operations more efficient.

2. How do online payroll management systems work?

An online payroll management system integrates multiple functions like attendance tracking, salary calculations, tax deductions, and statutory compliance. It automatically processes payroll based on predefined parameters, ensuring accurate salary disbursement and tax filings. The system also provides cloud access, allowing HR teams to manage payroll remotely and securely.

3. How does an online payroll system benefit businesses?

An online payroll and attendance management system improves efficiency by automating employee time tracking and payroll processing. It eliminates errors, ensures compliance with tax regulations, and enhances employee satisfaction by ensuring timely salary payments. Additionally, cloud-based accessibility allows seamless management from any location.

4. What are the key features for an online payroll system?

A robust online payroll software India includes features such as:

- Automated Salary Processing: Reduces manual effort and errors.

- Tax & Compliance Management: Ensures accurate tax calculations and timely filings.

- Attendance & Leave Integration: Tracks working hours for accurate salary computation.

- Multi-Device Cloud Access: Enables HR and employees to access payroll information anytime.

- Customisable Payroll Structure: Adapts to different salary structures and deductions.

- Secure Payment Processing: Ensures secure and timely employee payments.