As a small or medium-sized enterprise (SME) business owner, you juggle multiple responsibilities at once. From managing your staff to handling finances, there’s never a shortage of things to do. One critical aspect of running any business is handling payroll accurately and efficiently. And that’s where choosing the right online payroll software solution comes in.

Online payroll software for small businesses is designed to automate and streamline the payroll process, reducing manual errors and saving time. However, not all payroll tools and payroll programs are created equal, and selecting the wrong one can lead to costly mistakes.

All payroll providers and software vendors make high claims. So it’s important to have a plan to validate their superiority, and even more important– suitability to your business.

We suggest 4 categories to evaluate if the payroll software is suitable for your organisation –

- Does the payroll solution have all the key features needed for your organisation?

- Is the payroll management system up-to-date as per applied compliances and regulations?

- Payroll software provider’s implementation capability and customer service approach.

- SME friendly price.

In this blog post we will touch upon all these points. This will help you evaluate your vendors better.

Ask yourself these fundamental questions, before you go for a payroll solution.

Does the payroll solution generate ‘One Click’ Payroll Generation?

Now, let us tell you, all vendors claim ‘one-click solution’. But it isn’t ‘one-click’. You must go through the preparation before you make that ‘click’! But still, make sure everything is automated. Because if one-click needs you to upload data manually, that doesn’t make sense.

So, ask your payroll software for small business vendors about the exact work-flow and processes through which the payroll is generated.

Is the output accurate without any payroll errors?

Now payroll accuracy is something you will come to experience only when you use a software. So, go for a software with real testimonials. Rather, ask the software provider company for references from their clients. Talk to those clients and understand how accurate the payroll generation is?

Don’t be shy. Other people in business would surely give you good insights about the vendor.

Rules Engines: How flexible and configurable is the payroll system?

As an SME business owner, keep a close eye on this: Is the vendor’s software flexible and configurable to your needs? Or do they ask you to change your policies as per their software limitations?

Also ask–

Are their provisions to define various parameters as per Indian payroll compliances: Salaries and variable pays as per grades & job roles. Flexi-CTC, taxations and benefits, payslips!

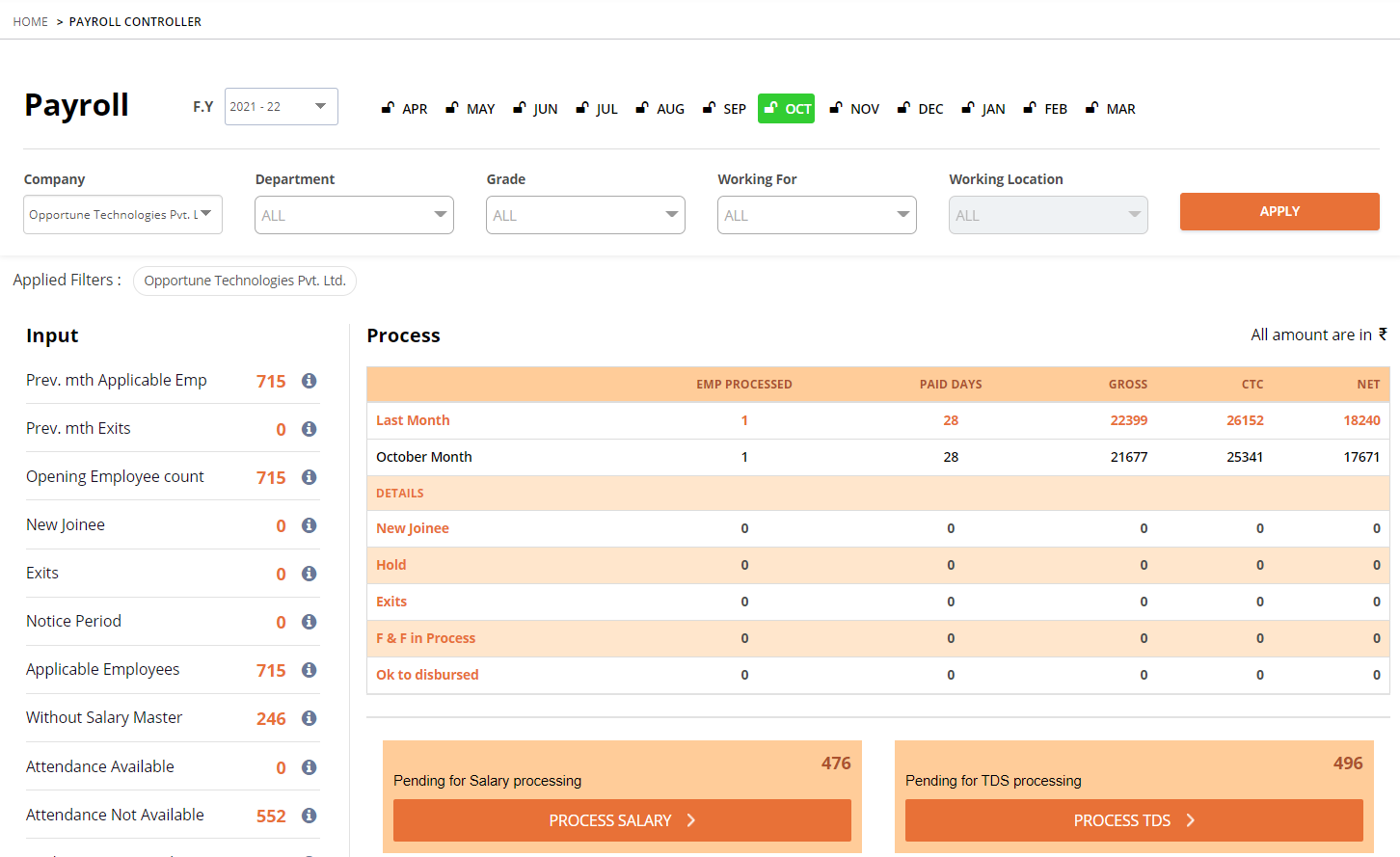

How well is the Payroll Dashboard designed?

A good payroll dashboard is a must. Not just the ‘beauty’ but the performance. Check that the payroll dashboard is designed to meet all payroll management requirements at a glance– New Joining, Exits, F&F, Arrears, Increments, monthly payroll comparisons, payroll trends, non-compliances.

Does the Payroll Controller help you tackle all the vital payroll functions?

Can you review the final salary register & lock payroll for the month? Is it geared to tackle: JV to Accounting system. Compliance payments, Quarterly TDS & payroll cost analysis.

Is the software up-to-date as per compliances and regulations?

Payroll regulations vary from region to region; therefore, it’s essential to choose a system that meets local compliance requirements fully. Non-compliance with local regulations can result in severe legal consequences and financial penalties. In case you have factories and offices in multi-locations, different states can have different legal requirements. Failure to comply can result in costly penalties and legal problems.

Especially take a close look at tax withholding laws, minimum wage requirements, overtime pay rules, sick pay entitlements, statutory holiday allowances, PPF contributions, pension contributions and more.

Industry specific payroll guidelines

In addition to checking whether your payroll and HR software for small business providers complies with regulatory standards, there might also be industry-specific regulations: Like, certifications of professionals in the health care industry. Do ask your HR payroll software provider if they have experience of handling such regulations.

It is also crucial that the payroll system can generate regulatory reports smoothly and easily. These reports are necessary for filing taxes and staying compliant with local government regulations. Therefore, an SME must choose a provider that offers reporting capabilities tailored to their needs.

OpportuneHR updates the new and changing compliances automatically in the software.

So your HR team shouldn’t worry about continuous tracking and updating of these laws. No manual updates needed.OpportuneHR is pre-configured for your industry and organisation requirements.

Now let’s address other important factors in choosing a payroll software for SME businesses

User-Friendliness

Most HRMS and payroll solutions will have a good list of features. But how they are integrated and related to each other in the system makes a real difference. A good design and integration of features make the software easy. And helps you get the best of those features.

Attractive design doesn’t mean it will be user-friendly!

User friendly is not the same as Some software could look attractive, but once you start using them you will discover. The usability is low. Or, it needs too many steps to reach to a particular date, or a report. We aren’t saying the interface should not be attractive. We too, work on it diligently. The point here is, don’t overlook the user-friendliness aspect of the software.

Especially so in an SME organisation, because you or your team may not have the time and resources to go through the steep learning curve. The software should be so user-friendly that your team doesn’t need to go through the initial 1 or 2 months of teething troubles. It should be so easy that someone can use it even without a prior experience of working with payroll processes and such softwares.

Employee Self-Service Portal

Employee self-service functionality is a critical feature of a good payroll system.

It allows employees to access their salary details, tax forms, and other important information on their own without relying on HR or management staff. They also get a good view of their incentives, employee benefits, and perks on a self-service portal. This saves time and also empowers employees by giving them control over their own data.

This feature alone can be the reason for migrating from desktop software to cloud-based payroll software. Because it frees HR from many trivial and small queries. They can use the short bandwidth towards important HR tasks like creating documents, and policies. And can work towards better recruitment, onboarding, and employee engagement activities.

Integration With Other Software

Integration capabilities are vital when choosing a payroll system because it must work with other systems within your organisation. For example, integrating with an accounting system can make it easier to manage finances while ensuring all data remains accurate across both systems. Payroll system and attendance management software must also be integrated well.

Integration capabilities refer to a software’s ability to communicate and share data with other systems within an organisation. In the case of payroll software, this means being able to exchange information with HR management systems, accounting software, time and attendance tracking tools, and other relevant applications. Having a payroll system that integrates well with other systems can increase efficiency by reducing manual data entry and eliminating errors caused by duplicate entries.

Examples of payroll software integration with other systems in the organisation

A good integration of your payroll system with other software also ensures that employee information is consistent across all platforms. For example, if you have made changes to an employee’s information in your HR management system but fail to update it in your payroll system, it can lead to discrepancies in salaries or tax filings. With integration capabilities, any changes made in one system are automatically updated across all connected platforms.

API makes a difference

You should also consider which type of integration method is best suited for your needs. Some vendors offer APIs (Application Programming Interfaces) which allow developers to create custom integrations with other software easily. This is what you should look for!

This leads us to 3 very significant evaluations!

Payroll software Provider’s HR Domain Expertise

The payroll is one of the most crucial factors in employee satisfaction and performance. But it is also complex in nature. An SME business may not have a dedicated payroll specialist. Or, may not have a high level of experience and expertise. So, even before the software, you should evaluate the payroll system vendor! Choose a vendor with strong HR domain expertise. The software should be designed in such a manner that it can address all HR-related tasks such as time-off requests, performance reviews, training records, and more.

Your vendor should have a good understanding of tax compliance, deductions, direct deposits, and other payroll-related terms and their significance.

And when a problem arises, the vendor should be able to understand your HR challenge, along with the technical issues.

Evaluate Implementation Capabilities And Customer Support Approach

Payroll software is not just software, consider it as a technology solution. Apart from the software features, how well the implementation is done makes a huge difference. (Keep an eye, what approach the payroll software provider have about customizing and configuring the software for you.)

Domain expertise again plays a vital role here. The software vendor must be able to understand the intricacies of payroll processes well to implement the solution in your organisation.

For your SME business, evaluating customer support options is a critical step. Because SME organisation’s needs are different. Good customer service is essential to ensure that any issues or concerns are addressed promptly and effectively.

Every vendor will claim good customer support. But there is a big difference in the quality of support.

Let us explain:

Most vendors provide you with technology software. Their support teams consider any support query as a technical query. And that creates a big gap. dissatisfaction. Because these customers support executives talk in technical lingo, which you or your employees will not understand.

On the other hand, when the HR personnel try to explain their difficulties, the technical team doesn’t understand that.

That’s why, make sure that the vendor support team has HR domain knowledge. And they talk in your language. You will thank us for this suggestion.

Balancing Cost and Functionality When Choosing Payroll Software

Don’t you want the best possible payroll features and functionalities for your organisation, at the most reasonable cost? Of course, you want!

There are 2 kinds of payroll software buying options available in the marketplace-

a: Cheap versions of enterprise solutions. We believe you aren’t looking for such payroll software.

b: High-end software created for corporate businesses. So, you end up paying for features which are not needed for an SME business.

Both scenarios are unfavorable to SME businesses.

Thankfully, a third option is available.

OpportuneHR is designed and developed for SME businesses.

So you can start with essential features at a reasonable price. You get world-class functionality, with superior and SME-friendly customer care. Then, as and when your business scales up, you can add more modules.

In conclusion:

An online payroll software for small businesses is crucial for Human resources teams in SME businesses. There are many benefits of payroll software. It can help HR team by saving time on mundane and complex HR processes. A cloud-based payroll platform is much better, as it assists them in fast and accurate payroll generation, salary slip generation and tax calculations. It provides them with quick access to payroll data and payroll reports.

Most importantly, it eliminates human errors which often crop in due to the making and merging of various Excel sheets.

When choosing online payroll software for your SME business, look for a system that is user-friendly and has employee self-service functionality. Ensure that the payroll system can scale with your organisation’s growth and accommodate local regulations while having integration capabilities with other systems. Most importantly, choose a payroll software company that has strong HR domain expertise tailored specifically to your organisation’s needs.

It’s worth noting that there isn’t a one-size-fits-all solution when it comes to payroll software selection. Therefore, we recommend you take the time to evaluate several options before making any final decisions.

Call us for a demo and see for yourself, the only HR software for SMEs!

FAQs About Payroll Software for SME

1. What is the best software for payroll for a small business?

The best payroll software for a small business is one that’s easy to use, affordable, and built for your needs. Look for a tool that automates salary calculations, tax deductions, payslip generation, and keeps you compliant with local laws. Opportune HR ticks all these boxes providing you an excellent payroll software that is also pocket friendly.

2. How to pick the right payroll software for SME business?

Here’s how you can choose the best payroll system for small business:

- Simple to navigate: Go for software that doesn’t need deep technical knowledge.

- Compliance Support: Make sure the software handles tax deductions, PF, ESI, and TDS automatically and according to updated rules.

- Integration: Look if it can be easily integrated with other company softwares like Human Resource Management System software.

- Scalability: It should have the option to upgrade as your business grows.

- Free Trial: Always test the software before you buy.

3. Why should SMEs choose cloud-based payroll software?

Cloud-based payroll software is ideal for SMEs because:

- You can access it from anywhere, even if you’re working remotely.

- It gets regular updates to stay compliant with tax rules.

- No need to worry about backups or server maintenance.

- It’s usually more cost-effective than desktop versions.

- Your data stays safe with built-in security and encryption features.